Triton to acquire Siemens Energy Trench Business

Frankfurt (Germany), 12 October 2023 - Triton Fund V advised by Triton (“Triton”) has today announced it has agreed on terms to acquire Siemens Energy’s Trench business (“Trench”). Terms and conditions of the transaction are not disclosed. Closing of the transaction, which is subject to regulatory approvals, Trench’s necessary consultations and other customary closing conditions, is expected during the first half of 2024.

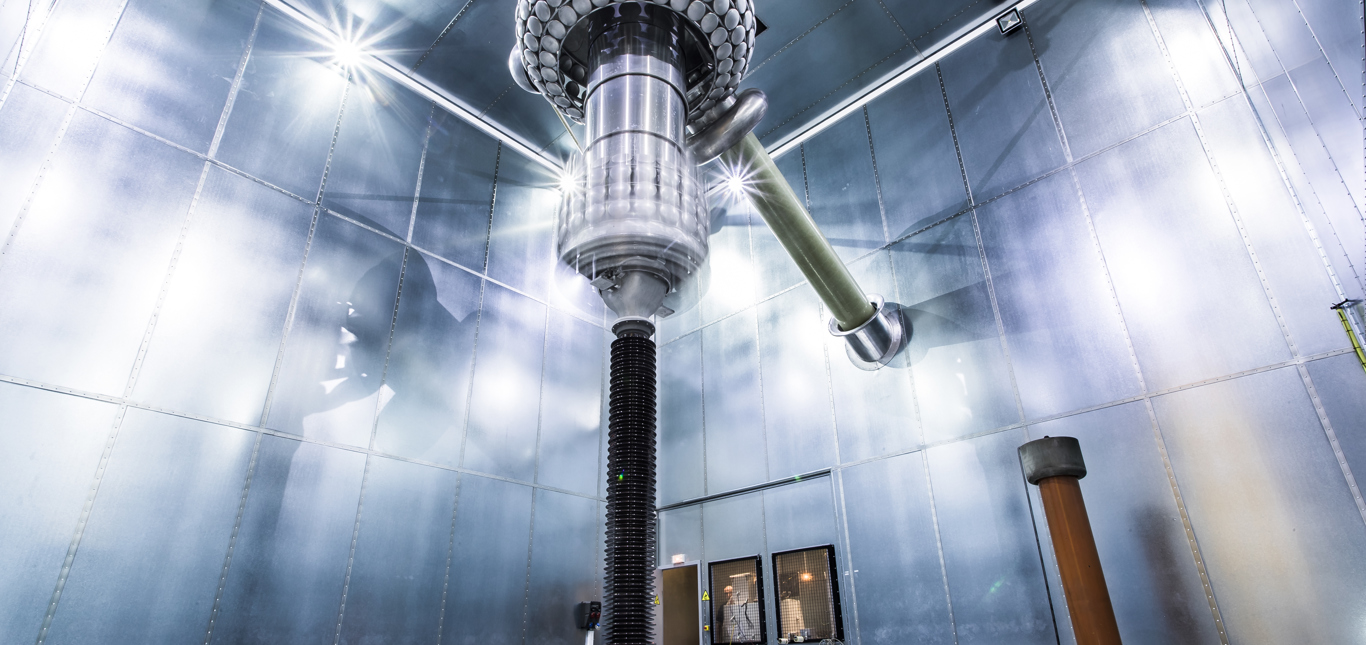

Trench specializes in the manufacturing of high-voltage grid components including bushings, instrument transformers and coil products, sold under the brands HSP and Trench. The business is a global leader in its markets, with 2.400 employees and nine factory locations across Europe, North America, and China, including Germany, Austria, France, Italy, Canada, and Bulgaria. Trench is ideally positioned to enable and benefit from the Energy Transition which constitutes a key investment theme for Triton.

Steffen Reimund, Investment Advisory Professional at Triton says: “We are impressed by Trench’s differentiated competitive positioning in the T&D component market, underscored by its deep technical know-how, a best-in-class product portfolio, its leading market positioning across all three segments and the long-standing and diversified relationship with blue chip customers. We look forward to supporting the management and employees on their journey to grow the business and to expand its market leadership in close collaboration with Siemens Energy through a long-term supply agreement."

Trench is at the heart of Triton’s investment focus to acquire market leading companies with high growth potential and a technological edge. Triton has a strong understanding and expertise of high voltage electrical equipment businesses based on previous experience in the sector and its investments in companies such as EQOS and Sediver. Additionally, Triton has successfully executed numerous corporate carve-outs from blue chip cooperations such as Bosch, SGL Carbon, Siemens, SKF, Voith and Volkswagen, among others.

About Triton

Founded in 1997 and owned by its partners, Triton is a leading European mid-market sector-specialist investor. Triton focuses on businesses that provide important goods and services in the Business Services, Industrial Tech, Healthcare, and Consumer sectors.

Triton has over 200 investment professionals across 11 offices and invests through three complementary “All Weather” strategies: Mid-Market Private Equity, Smaller Mid-Cap Private Equity, and Opportunistic Credit.

Fur further information: www.triton-partners.com

Press Contacts