Triton publishes annual Sustainability Reports to detail sustainability initiatives, data points, and updates on its approach, at both a firm-level and across its portfolio companies.

In addition, we publish periodic Sustainability Spotlight reports, that delve into specific sustainability themes.

Sustainability during the investment cycle

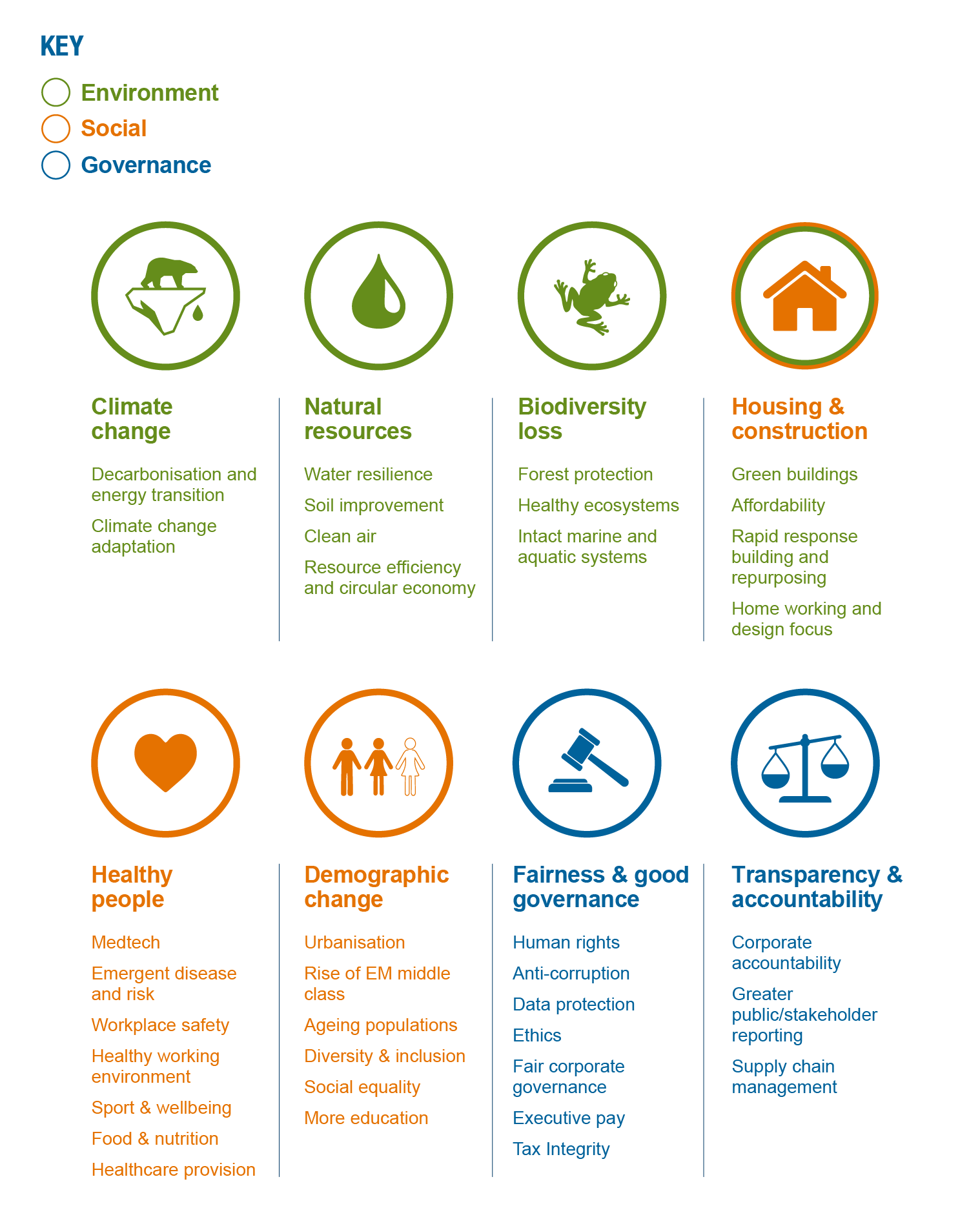

Investing behind sustainability megatrends

The United Nations’ (UN) Sustainable Development Goals (SDGs) set out a blueprint for a prosperous and sustainable world.

Triton believes that businesses have an important role to play in delivering positive social and environmental change. The SDGs help us to identify and prioritise our sustainability activities and demonstrate measurable impact against our goals.

We have aligned our material sustainability topics with the SDGs to which Triton and its portfolio companies can make the biggest contribution. These, including relevant SDG targets, are set out below.

Our SDG targets include: 8.4 Improve progressively, through 2030, global resource efficiency in consumption and production and endeavour to decouple economic growth from environmental degradation, 8.7 Take immediate and effective measures to eradicate forced labour, end modern slavery and human trafficking and 8.8 Protect labour rights and promote safe and secure working environmental for all workers.

Our SDG target: 10.2 By 2020, empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status.

Our SDG targets: 12.5 By 2030, substantially reduce waste generation through prevention, reduction, recycling and reuse and 12.7 Promote procurement practices that are sustainable, in accordance with national policies and priorities.

Our SDG targets: 13.1 Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters in all countries and 13.2 Integrate climate change measures into policies, strategies and planning.

Our SDG targets: 16.5 Substantially reduce corruption and bribery in all their forms and 16.6 Develop effective, accountable and transparent institutions at all levels.

Principles for Responsible Investment (PRI)

Triton has been a signatory to the United Nations-backed PRI since 2012 and was awarded an A+ rating for "Strategy and Governance" and Private Equity" modules in its most recent assessment in 2020.

As a responsible investor and over, Triton also actively engages on sustainability matters through a number of industry initiatives:

Other sustainability initiatives and commitments

BVCA (member of the Responsible Investment Advisory Group)

InvestEurope (member of the Core Group of the Responsible Investment Roundtable and Responsible Investment Advisory Group)

Initiative Climate International (founding member and co-chair of European network, Steering Committee member of the international network)

Triton Sustainability Policy

At Triton, we seek to grow and improve portfolio companies for long-term sustainability and for the benefit of multiple stakeholders. As such, we recognise the importance of sustainability issues in protecting and creating value for our investors, portfolio companies, and the communities where our portfolio companies operate.