Triton completes sale of FläktGroup to Samsung Electronics

Frankfurt / Herne (Germany), 6 November 2025 - Funds advised by Triton (“Triton”) have successfully completed the sale of FläktGroup (“the Company”), a European leader in energy-efficient indoor-air technology, to Samsung Electronics Co., Ltd.

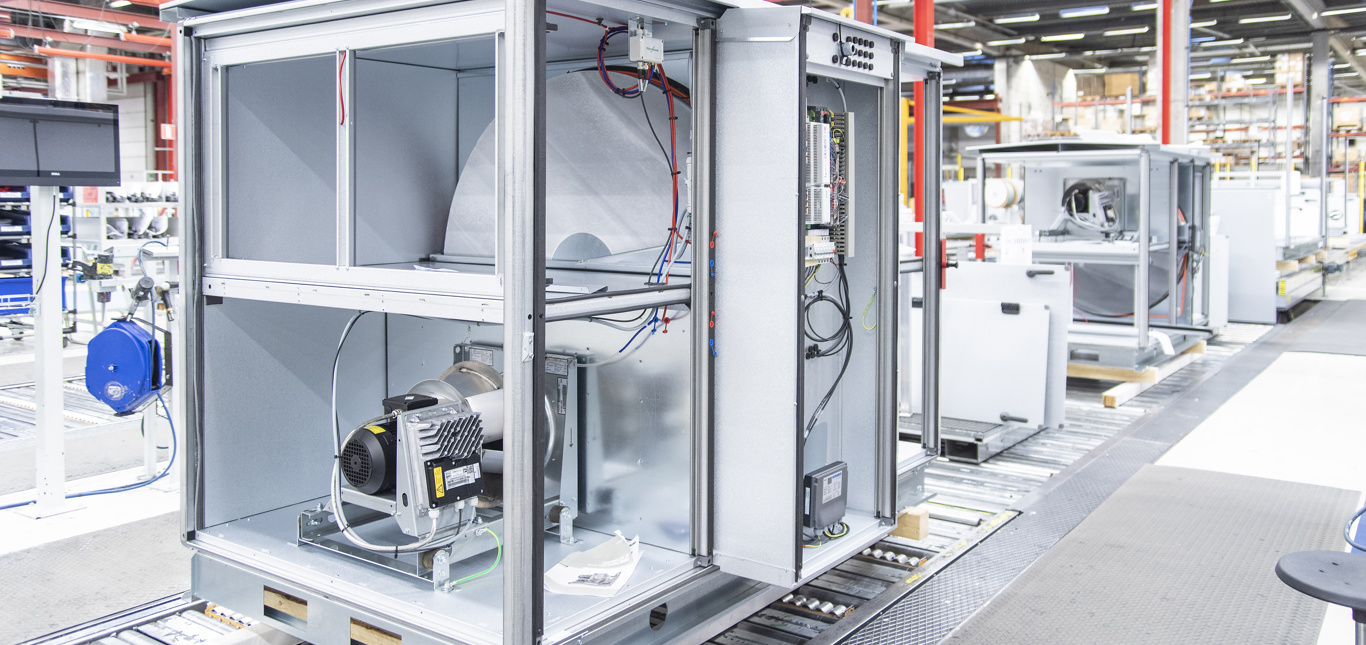

Triton formed FläktGroup in 2016 by acquiring Fläkt Woods and combining it with DencoHappel (acquired in 2014) to create a European market leader in air technology. The merger unlocked commercial and manufacturing synergies and established FläktGroup as a focused, standalone platform serving mission-critical end markets. During Triton’s ownership, the Company refined its portfolio, optimized its operations footprint, and invested in product development and digital capabilities - positioning FläktGroup to further solidify its position in the commercial ventilation market and gain share in attractive, fast growing segments such as data centers, gigafactories and healthcare.

About FläktGroup

FläktGroup is Europe’s leading specialist in energy-efficient indoor-air technology, delivering ventilation, air-conditioning, air-quality and fire-safety solutions that protect people, processes and the planet. Headquartered in Herne, Germany, the Group generates more than €700 million in annual revenue and employs roughly 3,300 people across 14 production sites, with operations spanning 65 countries worldwide. With a 100-year heritage of engineering excellence, FläktGroup serves mission-critical environments – from data centers and gigafactories to hospitals, schools and homes – enabling customers to achieve superior indoor climates while meeting stringent energy and sustainability targets.

For further information: www.flaktgroup.com/

About Triton

Founded in 1997 and owned by its partners, Triton is a leading European mid-market sector-specialist investor. Triton focuses on investing in businesses that provide mission critical goods and services in its three core sectors of Business Services, Industrial Tech, and Healthcare.

Triton has over 150 investment professionals and value creation experts across 11 offices and invests through three complementary “All Weather” strategies: Mid-Market Private Equity, Smaller Mid-Cap Private Equity, and Opportunistic Credit.